SD RV066 2003-2025 free printable template

Show details

Exemption Certificate South Dakota Department of Revenue RV066 Revised 01/03 445 E. Capitol Avenue Pierre SD 57501-3100 1-800-TAX-9188 THIS CERTIFICATE IS NOT VALID IF THE PURCHASER DOES NOT INDICATE BASIS FOR THEIR EXEMPTION. INFORMATION ON EXEMPT TRANSACTIONS IS ON THE BACK OF THIS FORM.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SD RV066

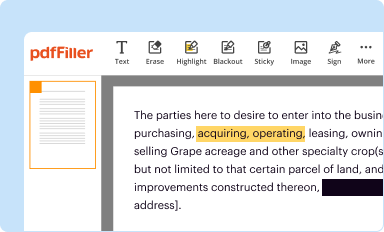

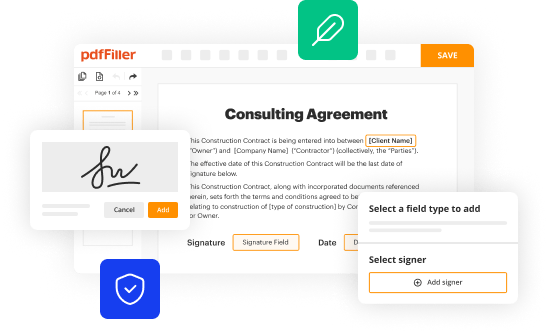

Edit your SD RV066 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SD RV066 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit SD RV066 online

Follow the steps down below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit SD RV066. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SD RV066 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SD RV066

How to fill out SD RV066

01

Begin by downloading the SD RV066 form from the official website or retrieving a physical copy.

02

Fill in your personal information in the designated fields, including your name, address, and contact details.

03

Provide any required identification numbers, such as Social Security Number or tax identification number.

04

Complete the sections that pertain to the nature of your request or application.

05

Double-check all entries for accuracy and completeness, ensuring no sections are left blank unless specified.

06

Sign and date the form at the bottom to validate your submission.

07

Submit the form as instructed, either online, via mail, or in person, depending on the filing requirements.

Who needs SD RV066?

01

Individuals or businesses who need to apply for a specific service or benefit related to SD RV066.

02

Anyone seeking compliance with regulations that require the submission of the SD RV066 form.

03

Professionals or representatives filing on behalf of others who meet the eligibility criteria outlined in the form.

Fill

form

: Try Risk Free

People Also Ask about

What is SD excise tax rate?

A 2% contractor's excise tax is imposed on the gross receipts of all prime and subcontractors engaged in construction services or reality improvement projects.

What is the penalty for late sales tax in South Dakota?

An interest charge of 1% (. 01) will be assessed each month on any past due tax until the tax is paid in full. (A minimum of $5.00 interest is due the first month).

Do I need a resale certificate in South Dakota?

Businesses that purchase products or services for resale must provide an exemption certificate listing their tax permit number to the seller. If the business is from a state that does not issue sales tax numbers, the business should list its FEIN.

What is the use tax in Rapid City SD?

The South Dakota sales tax rate is currently 4.5%. The County sales tax rate is 0%. The Rapid City sales tax rate is 2%.

What is South Dakota sales and excise tax?

The South Dakota sales tax and use tax rates are 4.5%.

What is the sales tax rate in South Dakota 2023?

PIERRE, S.D. – On July 1, 2023, South Dakota's tax rate will decrease from 4.5 percent to 4.2 percent. Governor Kristi Noem and the Department of Revenue are working diligently to account for the three-tenth percent sales tax decrease created by House Bill 1137.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get SD RV066?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific SD RV066 and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I edit SD RV066 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign SD RV066 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I complete SD RV066 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your SD RV066. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is SD RV066?

SD RV066 is a tax form used to report certain sales, use, and related taxes in specific jurisdictions.

Who is required to file SD RV066?

Businesses or individuals who engage in taxable sales or use of goods and services in the applicable jurisdiction are required to file SD RV066.

How to fill out SD RV066?

To fill out SD RV066, gather sales and use tax information for the reporting period, complete the form with proper figures, and follow any specific instructions related to the form.

What is the purpose of SD RV066?

The purpose of SD RV066 is to ensure accurate reporting and compliance with sales and use tax obligations to the relevant tax authority.

What information must be reported on SD RV066?

Information that must be reported on SD RV066 includes total sales, taxable sales, tax collected, and any exemptions or deductions applied during the reporting period.

Fill out your SD RV066 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SD rv066 is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.